The Intelligent Document Processing (IDP) software market is experiencing a seismic shift. What began as simple Optical Character Recognition (OCR) has evolved into sophisticated AI-powered systems that don’t just read documents—they understand, analyze, and act on them. For businesses still relying on legacy document processing solutions, the transformation happening right now could determine their competitive advantage for the next decade.

From 99% Price Drops to AI Revolution: The IDP Market Reality

The numbers tell a compelling story. Over the past 20 years, OCR costs have plummeted by 99%—from expensive enterprise solutions to Microsoft Azure Read’s $0.001 per page. Yet this dramatic price reduction hasn’t commoditized the market. Instead, it’s created space for entirely new categories of intelligent document processing.

Traditional OCR was just text recognition. Today’s IDP software encompasses table detection, document classification, data extraction, and increasingly, contextual understanding through large language models (LLMs). The question isn’t whether AI will disrupt document processing—it’s how quickly businesses can adapt to leverage these capabilities.

The Multimodal AI Advantage: Why Modern IDP Goes Beyond Text

Large language models have introduced a game-changing capability: multimodal processing. Instead of working solely with text representations or HTML-like markdown, advanced IDP solutions now analyze both the visual layout and textual content of documents simultaneously. This approach captures formatting, spatial relationships, and visual cues that pure text processing misses.

However, this power comes with important caveats. As Microsoft acknowledges with their Kosmos-2.5 model: “Since this is a generative model, there is a risk of hallucination during the generation process, and it CAN NOT guarantee the accuracy of all OCR/Markdown results.” This limitation explains why specialized IDP vendors continue to thrive alongside general-purpose AI models.

Market Consolidation and Strategic Positioning

The IDP market is experiencing significant consolidation. Companies like Bechtle are acquiring Planet AI, DocuWare purchased Natif, and SER acquired Klippa. This consolidation reflects a broader trend: IDP is moving from standalone technology to integrated business process solutions.

The Pricing Model Evolution

Many specialized document processing vendors are shifting their business models:

- Base64 now requires $4,430 annual minimums

- Rossum has implemented $18,000 yearly commitments

- Nanonets introduced €200 minimums while modularizing pricing

- Quick-Extract and Mindee maintain pay-per-page models without minimums

This pricing evolution reflects the market’s maturation and the increasing sophistication required to deliver enterprise-grade document intelligence.

Vertical Specialization: The New Competitive Moat

The most successful IDP companies are moving beyond horizontal technology platforms to become vertical specialists. This shift recognizes that deep domain expertise often matters more than pure technological capability.

Examples of successful vertical specialization include:

- Healthcare: Companies like Tennr focus specifically on medical document workflows

- Legal: Specialized contract processing solutions

- Financial Services: Automated invoice and financial document processing

- Real Estate: Property document management systems

These vertical specialists benefit from AI’s democratization of sophisticated functionality while building defensible moats through industry-specific knowledge and integrations.

The Enterprise AI Transformation: Lessons from Silicon Valley

Recent insights from leading venture capital firms reveal critical patterns in enterprise AI adoption that directly impact IDP software selection:

Speed and Momentum Matter More Than Ever

In today’s AI landscape, “momentum is the moat.” Early-moving IDP vendors are establishing category leadership faster than in previous technology cycles. Companies that move quickly to establish brand recognition, customer base, and product sophistication create compounding advantages that become difficult for competitors to overcome.

The 10x Growth Expectation

Traditional SaaS companies celebrated reaching $1 million ARR in their first year. Today’s AI-powered IDP companies regularly achieve 10x year-over-year growth rates. This acceleration stems from:

- Active buyer demand: Enterprises have dedicated AI budgets and mandates

- Larger contract sizes: AI solutions often replace labor budgets, not just software budgets

- Compressed sales cycles: The value proposition is immediately evident

Building Sustainable Competitive Advantages

While AI democratizes sophisticated capabilities, successful IDP companies still need traditional moats:

- System of Record Status: Becoming the authoritative source for document data and workflows

- Workflow Lock-in: Embedding into daily operational processes

- Deep Integrations: Connecting with legacy systems and specialized industry platforms

- Trusted Relationships: Acting as strategic AI advisors, not just technology vendors

The Data Challenge: From Annotation to Expert Evaluation

The evolution of AI training reveals why specialized IDP vendors maintain advantages over general-purpose models. Early machine learning required massive labeled datasets—think thousands of annotators marking up millions of documents. Today’s frontier models require something different: expert evaluation and domain-specific training data.

Modern AI model improvement follows this progression:

- Supervised Learning Era: Large volumes of basic labeled data

- RLHF Period: Human preference feedback from general users

- Reinforcement Learning Phase: Expert-created evaluation frameworks and domain-specific rubrics

For document processing, this means the most advanced capabilities come from models trained on data created by industry experts—accountants for financial documents, lawyers for contracts, medical professionals for healthcare records. This expert requirement creates natural barriers to entry and explains why vertical IDP specialists can compete effectively against horizontal AI platforms.

Choosing the Right IDP Solution: Strategic Considerations

Given this market evolution, organizations evaluating IDP software should consider:

Technology Capabilities

- Multimodal processing: Can the solution handle both visual and textual document elements?

- Model flexibility: Does the vendor use multiple AI models optimized for different tasks?

- Accuracy guarantees: What safeguards exist against AI hallucinations in critical processes?

Business Model Alignment

- Pricing structure: Does the cost model align with your document volume and growth projections?

- Minimum commitments: Are you comfortable with annual minimum requirements?

- Scalability: Can the solution grow with your business needs?

Strategic Positioning

- Industry expertise: Does the vendor understand your specific document types and workflows?

- Integration capabilities: How well does the solution connect with your existing systems?

- Roadmap alignment: Is the vendor investing in capabilities that match your future needs?

Intelligent Document Processing beyond 2025

Understanding the Multimodal Challenge

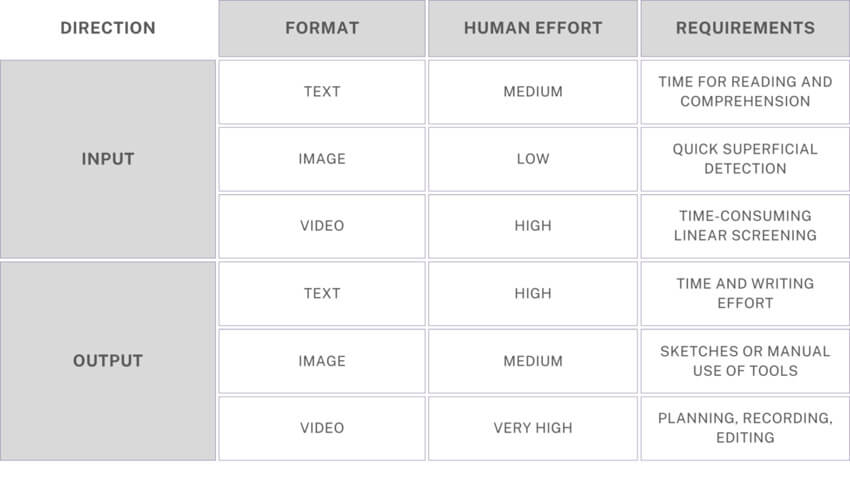

The accompanying matrix reveals a critical insight about enterprise content management: the human effort required varies dramatically based on both direction (input vs. output) and format complexity. While text input requires medium effort for reading and comprehension, video output demands very high effort for planning, recording, and editing. This asymmetry creates bottlenecks that ripple through enterprise systems like PIM (Product Information Management), CRM, and ERP platforms.

Consider a product manager updating a PIM system with new specifications. Traditionally, this involves high-effort text output—writing detailed descriptions, creating documentation, and manually formatting content. Meanwhile, the rich visual content from engineering (CAD files, prototypes, demonstration videos) requires time-consuming linear screening to extract actionable insights. This mismatch between input complexity and output demands creates friction that fluid documents are uniquely positioned to resolve.

The Enterprise Content Transformation

In CRM systems, customer interactions generate diverse content streams: support tickets with screenshots, voice recordings from sales calls, email threads with attachments, and social media mentions with embedded media. Current systems force this heterogeneous input through rigid data models, losing context and nuance. Fluid documents transform these interactions into adaptive, role-specific views—sales teams see relationship insights and opportunity signals, while support teams access structured problem-solution patterns derived from the same underlying data.

ERP systems face similar challenges when processing vendor communications, compliance documentation, and operational reports. A single vendor invoice might arrive as a PDF scan, reference purchase orders stored as XML, and trigger approval workflows documented in email threads. Fluid documents unify these disparate formats into coherent business objects that adapt their presentation based on the accessing user’s role and decision-making needs.

Strategic Implications for Enterprise Architecture

The shift from traditional IDP to fluid document processing represents a fundamental architectural evolution. Where conventional systems treat documents as static artifacts to be parsed and stored, the new paradigm views them as dynamic interfaces that continuously reshape themselves based on context and intent. This transformation affects core enterprise functions:

Product Information Management evolves from catalog maintenance to dynamic content orchestration. Product specifications automatically adapt for different audiences—technical details for engineers, marketing copy for sales teams, compliance information for regulatory review—all derived from a single fluid source that incorporates multimodal inputs from design, manufacturing, and market feedback.

Customer Relationship Management transcends traditional contact and opportunity tracking. Customer interactions become living documents that synthesize communication history, preference patterns, and engagement signals across all touchpoints. The same customer profile presents differently to sales (showing pipeline opportunities), support (highlighting recurring issues), and marketing (revealing content engagement patterns).

Enterprise Resource Planning transforms from transaction recording to intelligent process orchestration. Purchase requisitions, approval workflows, and vendor communications merge into adaptive business processes that surface relevant information precisely when and how decision-makers need it.

The Competitive Advantage of Document Intelligence

Organizations that recognize this shift gain several strategic advantages. First, they reduce the cognitive load on knowledge workers who no longer need to mentally synthesize information across multiple formats and systems. Second, they accelerate decision-making by presenting contextually relevant information without the traditional overhead of searching, filtering, and formatting. Third, they create more agile operations where business processes can adapt to new information sources and changing requirements without extensive system modifications.

The differentiation in this emerging landscape comes not from document processing accuracy—that’s becoming commoditized—but from the sophistication of contextual adaptation and role-based intelligence. Companies that master the orchestration between human intent and AI-powered content transformation will find themselves operating with fundamentally different efficiency and insight capabilities than their competitors.

The transformation from static document processing to dynamic, multimodal intelligence represents more than technological evolution—it’s a reimagining of how enterprise knowledge flows through organizations. Companies that embrace this shift will discover that their information systems become strategic assets capable of adapting and evolving alongside their business needs, rather than constraints that limit operational agility.